How to package and ship natural stone slabs safely

International shipping of natural stone slabs requires professional and secure packaging to prevent breakage, scratches, moisture damage, and costly product loss.

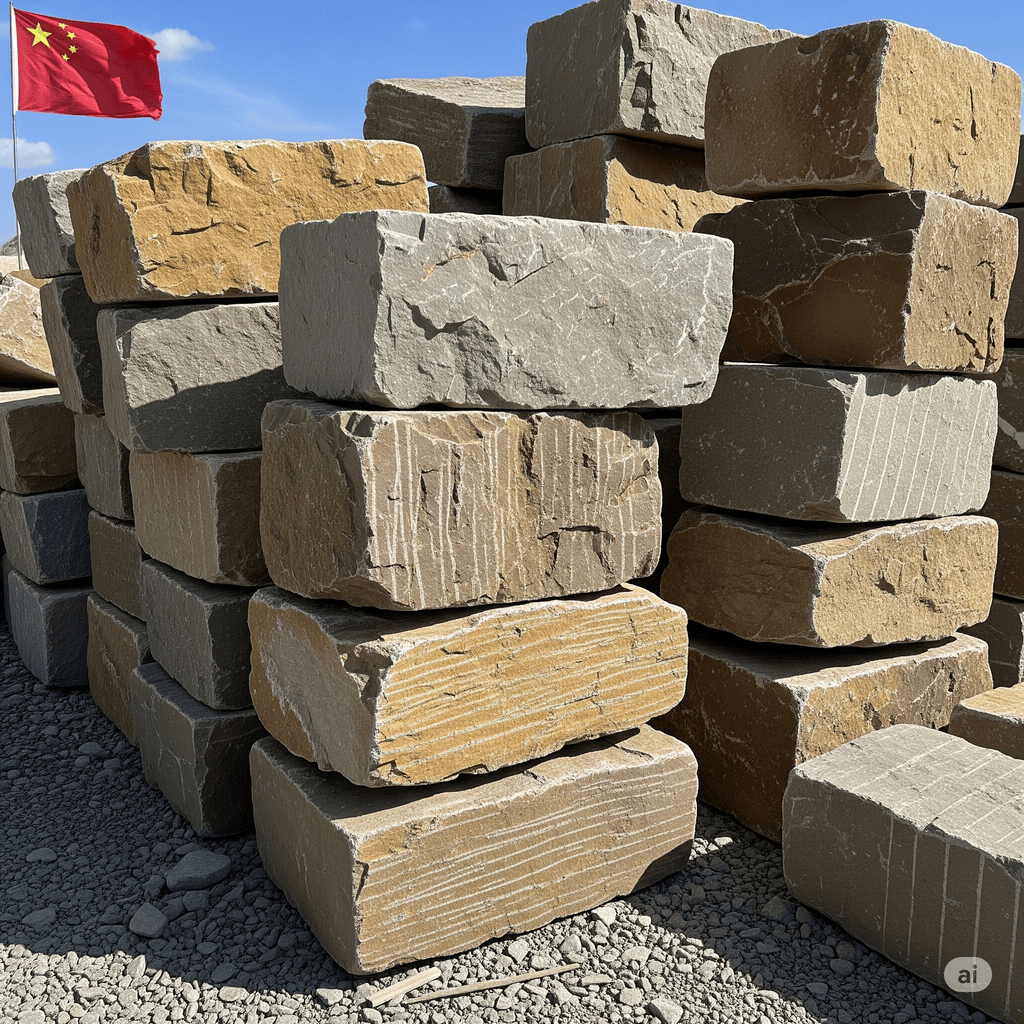

The building stone market in China ranks among the largest and most dynamic globally. Fueled by rapid urbanization, vast infrastructure projects, and growing demand for durable natural materials, this market offers abundant opportunities for manufacturers, exporters, and investors worldwide. This report combines in-depth market analysis with the latest data on production, imports, exports, pricing, and strategic growth prospects.

China’s Building Stone Market Overview (2024)

China’s total building stone consumption—including granite, sandstone, marble, and other natural stones—reached approximately 253 million tonnes in 2024, reflecting a 12% year-over-year growth. The market value surged to an estimated $27 billion, underscoring China’s ongoing construction boom.

Imports and Exports: Evolving Trade Dynamics

China’s growing appetite for premium and exotic stones is reflected in its import patterns:

Market Drivers Fueling Growth

Challenges Impacting the Market

Technology & Processing Advances

Advancements in cutting, polishing, and finishing techniques are enhancing product quality and variety, enabling manufacturers to meet sophisticated architectural demands and elevate market competitiveness.

Market Outlook: Forecast to 2035

The building stone market in China is projected to grow at a compound annual growth rate (CAGR) of 2.7% from 2024 to 2035. By 2035, total consumption is expected to reach 340 million tonnes, with market value surpassing $40.8 billion.

Globally, the natural stone industry is forecasted to expand at a CAGR of approximately 3.3%, reaching nearly $56 billion by 2034, with China remaining the largest and fastest-growing market in the Asia-Pacific region.

Export Opportunities for Global Suppliers

Countries like Iran, known for rich and diverse natural stone resources (granite, marble, travertine), are well positioned to benefit from China’s expanding demand. Competitive advantages include:

To capitalize on these opportunities, exporters should focus on:

Conclusion

China’s building stone market presents significant growth opportunities despite challenges such as price pressures and regulatory complexities. Sustained urbanization, evolving consumer preferences for luxury natural stones, and government-driven industrial upgrades underpin a robust future outlook.

For international suppliers and exporters, aligning product quality, sustainability practices, and market strategies with China’s demands will be key to capturing a larger market share in this expanding sector.

International shipping of natural stone slabs requires professional and secure packaging to prevent breakage, scratches, moisture damage, and costly product loss.

Natural stone is one of the most versatile building materials in the world. However, its final look, performance, and even price depend greatly on the finishing method applied

The global shift toward sustainable construction is transforming the way natural stone is quarried, processed, and exported.