How to package and ship natural stone slabs safely

International shipping of natural stone slabs requires professional and secure packaging to prevent breakage, scratches, moisture damage, and costly product loss.

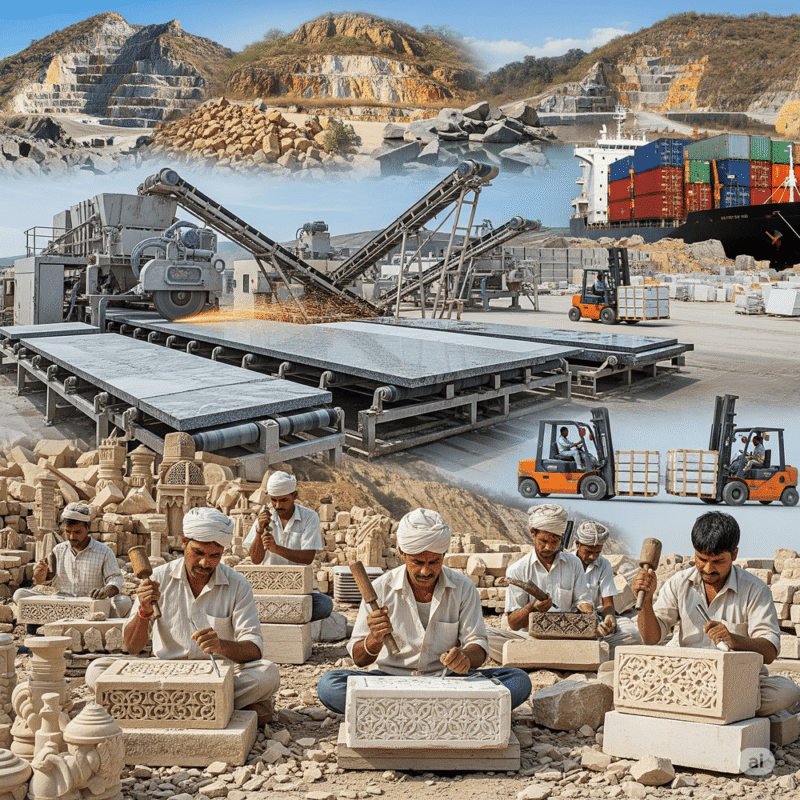

India is one of the world’s leading players in the natural stone industry, known for its rich geological diversity and centuries-old stone craftsmanship. In 2024, the Indian building stone market continues to play a vital role in global construction supply chains, driven by strong domestic demand, rising exports, and evolving production technologies. This blog provides a comprehensive analysis of the current market situation, future trends, export potential, challenges, and strategic insights for businesses looking to invest or expand in this dynamic sector.

Current Market Overview

India’s natural stone industry includes granite, marble, sandstone, limestone, and slate—each with significant domestic and international demand.

India ranks among the top 3 global exporters of granite and sandstone, with major export destinations including China, the U.S., Vietnam, the UAE, and European markets.

Recent & Future Trends

1. Domestic Infrastructure Push

Massive investments in urban housing, roads, railways, and public infrastructure under programs like Smart Cities Mission and PM Gati Shakti have fueled domestic demand.

2. Export Diversification

While China and the U.S. remain key buyers, Indian exporters are increasingly tapping into new markets in Southeast Asia, Africa, and Latin America due to shifting geopolitical and trade dynamics.

3. Digital & Automation Adoption

New-age stone processing units are embracing CNC machines, robotic cutting, and digital templating to enhance precision, reduce waste, and improve competitiveness.

4. Sustainable Quarrying

Regulatory focus on environmental compliance has led to increased adoption of eco-friendly quarrying practices and waste recycling in stone processing.

Export & Trade Opportunities

India has a strong competitive advantage in global stone exports due to:

Export Highlights (2024):

Opportunity for Iranian suppliers: Iranian exporters of high-quality marble and travertine can consider joint ventures or partnerships with Indian fabricators for value-added export to third markets.

Challenges & Market Risks

Competitive Landscape & Technology

India’s stone processing industry is undergoing a technological transition:

Strategic Recommendations

For international businesses looking to enter or expand in the Indian building stone market:

Conclusion

India’s building stone market is a blend of tradition and innovation—offering vast opportunities for domestic growth and global trade. While environmental compliance and logistics remain key hurdles, India’s abundant resources, skilled labor, and rising global presence make it a dominant force in the natural stone industry. With the right partnerships and forward-looking strategy, businesses can tap into India’s market as both a production hub and export gateway.

Call to Action

Looking to connect with reliable partners or explore sourcing options in India’s stone industry?

📩 Get in touch with our export advisory team today for tailored insights, supplier introductions, and market entry strategies.

International shipping of natural stone slabs requires professional and secure packaging to prevent breakage, scratches, moisture damage, and costly product loss.

Natural stone is one of the most versatile building materials in the world. However, its final look, performance, and even price depend greatly on the finishing method applied

The global shift toward sustainable construction is transforming the way natural stone is quarried, processed, and exported.